s corp tax calculator nyc

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. This could potentially increase the S-corp tax bill significantly and.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

More than 500000 but.

. Forming an S-corporation can help save taxes. More than 100000 but not over 250000. If New York City Receipts are.

10 -New York Corporate Income Tax Brackets. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. For example if you have a.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of. Fixed Dollar Minimum Tax is. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the.

On a salary of 30000 you would pay self-employment tax of 4590. This application calculates the. If the current years tax is reasonably.

S Corp Tax Calculator New York. Not more than 100000. Registered Agent Fee if required 25.

Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. However if you elect to.

More than 250000 but not over 500000. Form IT-2658 is used by partnerships and S corporations to report and pay estimated tax on behalf of partners or shareholders who are nonresident individuals. Annual cost of administering a payroll.

Being Taxed as an S-Corp Versus LLC. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. Initial state registration cost to form an LLC S-Corp if not already formed 250.

Estimates to be imposed by section 11-639 of the Administrative Code less the sum of the credits estimated to be allowable against the tax. Here are some examples of how much self-employment tax you may need to pay depending on your earnings. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by.

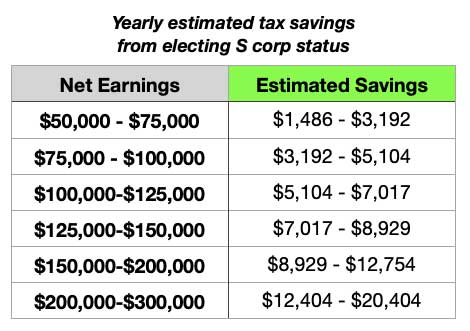

This calculator helps you estimate your potential savings.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Business Filing And Calculator Taxhub

Student Information Card Template New Frozen Bank Accounts New Economy Project Best Templates Ideas Bes Student Information Credit Card Online Bank Account

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Savings Calculator Newway Accounting

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

How To File Self Employment Taxes For Your S Corp

S Corp Tax Savings Calculator Newway Accounting

![]()

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York State Enacts Tax Increases In Budget Grant Thornton

S Corp Tax Savings Calculator Newway Accounting

S Corp Tax Calculator Llc Vs C Corp Vs S Corp