additional tax assessed by examination

575 rows Additional tax assessed by examination. Especially for those with amended returns or for those.

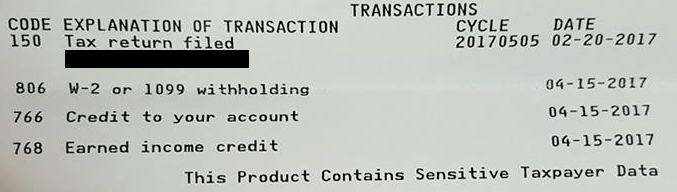

Irs Refund Payments Update Common Transcript Codes Around Your Refund Payment Youtube

Taxable amended returns received within 120 days of the ASED - The group examiner will follow the procedures below for assessing the taxable amended return.

. Your return may be examined for a variety of reasons and the examination may take place in any one of several ways. After deductions our taxable income was 43342. Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they were.

Posted on Apr 28 2015 It may be disputed. The original tax assessed was 2485. Well I recently checked my IRS account and they say I now.

August 11 2022. The 23C date is the Monday on which the recording of. In the year of 2018 My wife and I filed jointly.

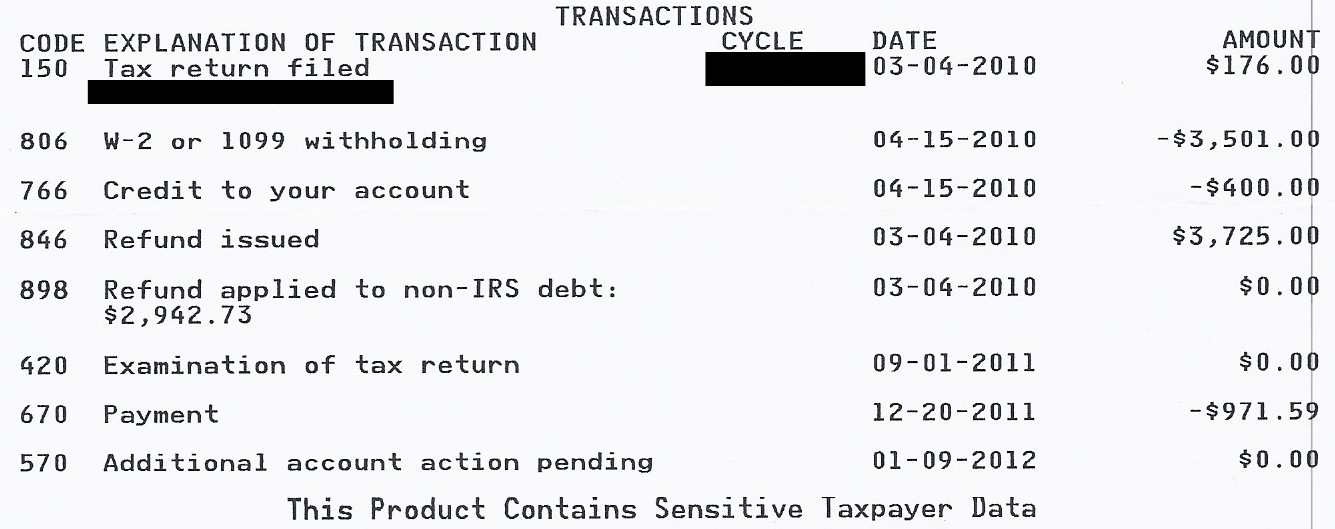

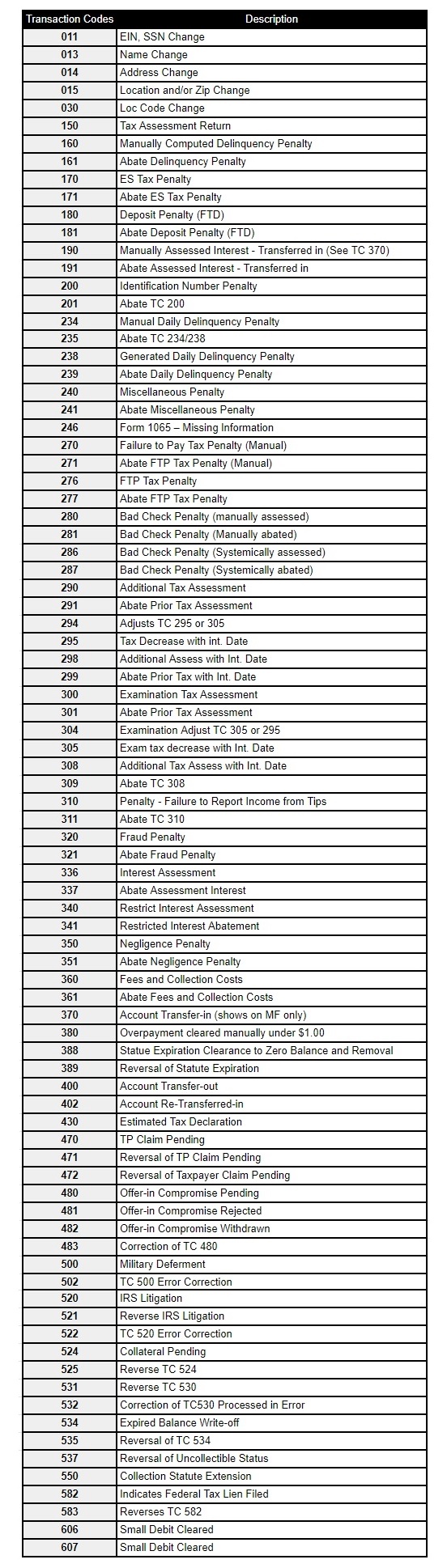

Code 290 is indeed an additional tax assessment. The assessment date is the 23C date. Code 290 is for Additional Tax Assessed.

Additional Tax or Deficiency Assessment by Examination Div. Assessment is made by recording the taxpayers name address and tax liability. You understated your income by more that 25 When a taxpayer.

I will double check with the cleint concerning the medical. If the amount is greater than 0 youll. For more information about petitioning US.

But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed. I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. Assesses additional tax as a result of an.

The transcript code is 290 which just says additional tax assessed. An examination of a tax year after the statute of limitations is expired is an unnecessary examination because generally no assessment of tax can be. The purpose of this section is to provide International Individual Compliance IIC examiners and managers procedural guidance for examining tax returns for the IIC taxpayer population.

Seeing the words additional tax assessed on their IRS tax transcript may create a sense of panic in may tax filers. As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding. Upon looking into my account online I found that I have been charged code 290.

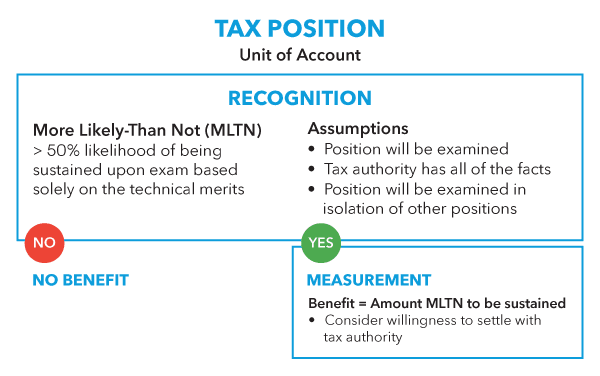

Additional tax could be assessed. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you. The Court of Final Appeal held that a corporation instead of its directors is required to file a profits tax return pursuant to the Inland Revenue Ordinance.

After the examination if any changes to your tax are proposed you. We payed 5610 in federal taxes. 83 rows Employees in Accounts Management respond to taxpayer inquiries.

If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. Tax Court see page 5 of Publication 3498-A or visit wwwustaxcourtgov Audits by Mail The IRS will send a. Recommended Additional Tax and Returns with Unagreed Additional Tax After Examination by Type and Size of Return by Fiscal Year.

How To Handle An Irs Audit When To Get Expert Help H R Block

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Asc 740 Uncertain Tax Positions Bloomberg Tax

Registration Requirements Odessa Elementary School

Trends In The Internal Revenue Service S Funding And Enforcement Congressional Budget Office

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Irs Transaction Codes Ths Irs Transcript Tools

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

Irs Transaction Codes And Error Codes On Transcripts

Irs Account Transcript The Dancing Accountant

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Will I Get Audited If I File An Amended Return H R Block

Irs Transcript Transaction Codes Where S My Refund Tax News Information

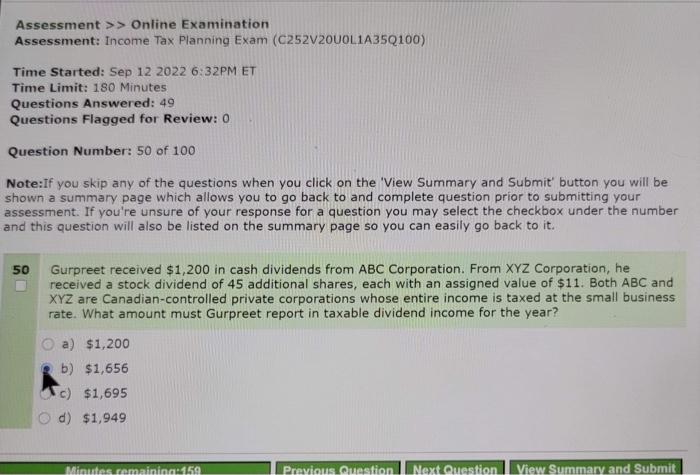

Solved Assessment Online Examination Assessment Chegg Com

Oklahoma Register 06 15 1998 V 15 No 16 Oklahoma Register Oklahoma Digital Prairie Documents Images And Information

Tax Transcript Codes Where S My Refund Tax News Information

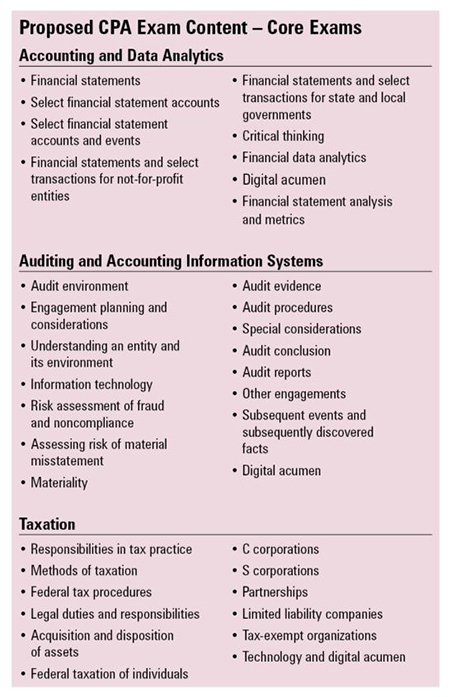

The New Improved Cpa Exam A Look Inside The Cpa Evolution Updates

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service